How much can i borrow mortgage based on salary

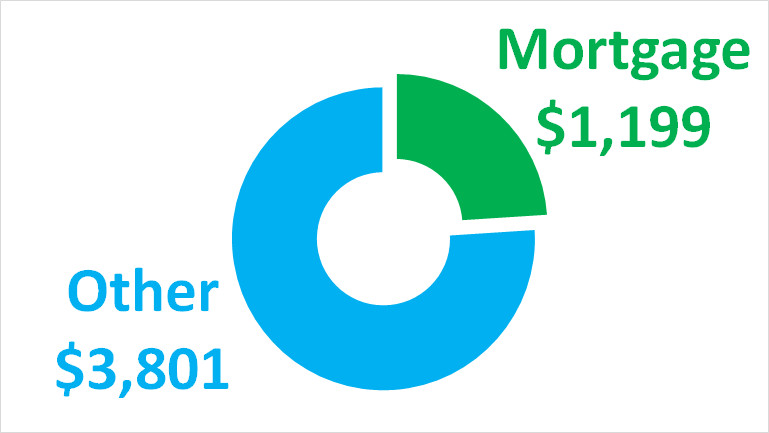

Your emergency money can go toward paying your mortgage if need be and having it set aside can give you a little more peace of mind when determining how much you can realistically afford to pay for a house. Factor in income taxes and more to better understand your ideal loan amount.

Still Waiting For The Salary Just Get Yourself Rupeeredee Instant Personal Loan Pay Your Bills On Time Isn T It Simple C Personal Loans Borrow Money Loan

Myth 2 The maximum loan amount you can get from each bank doesnt vary much.

. Lets presume you and your spouse have a combined total annual salary of 102200. See the average mortgage loan to income LTI ratio for UK borrowers. Find out what you can borrow.

Now that weve completed the number crunching lets take a look at whether your salary can buy property in Malaysia. 31000 23000 subsidized 7000 unsubsidized Independent. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Usually banks and. Unlike a residential mortgage where the amount you can borrow is based on your salary and your outgoings a Buy to Let mortgage is assessed on the rental income that the property is likely to generate. Mortgage calculator UK - find out how much you can borrow.

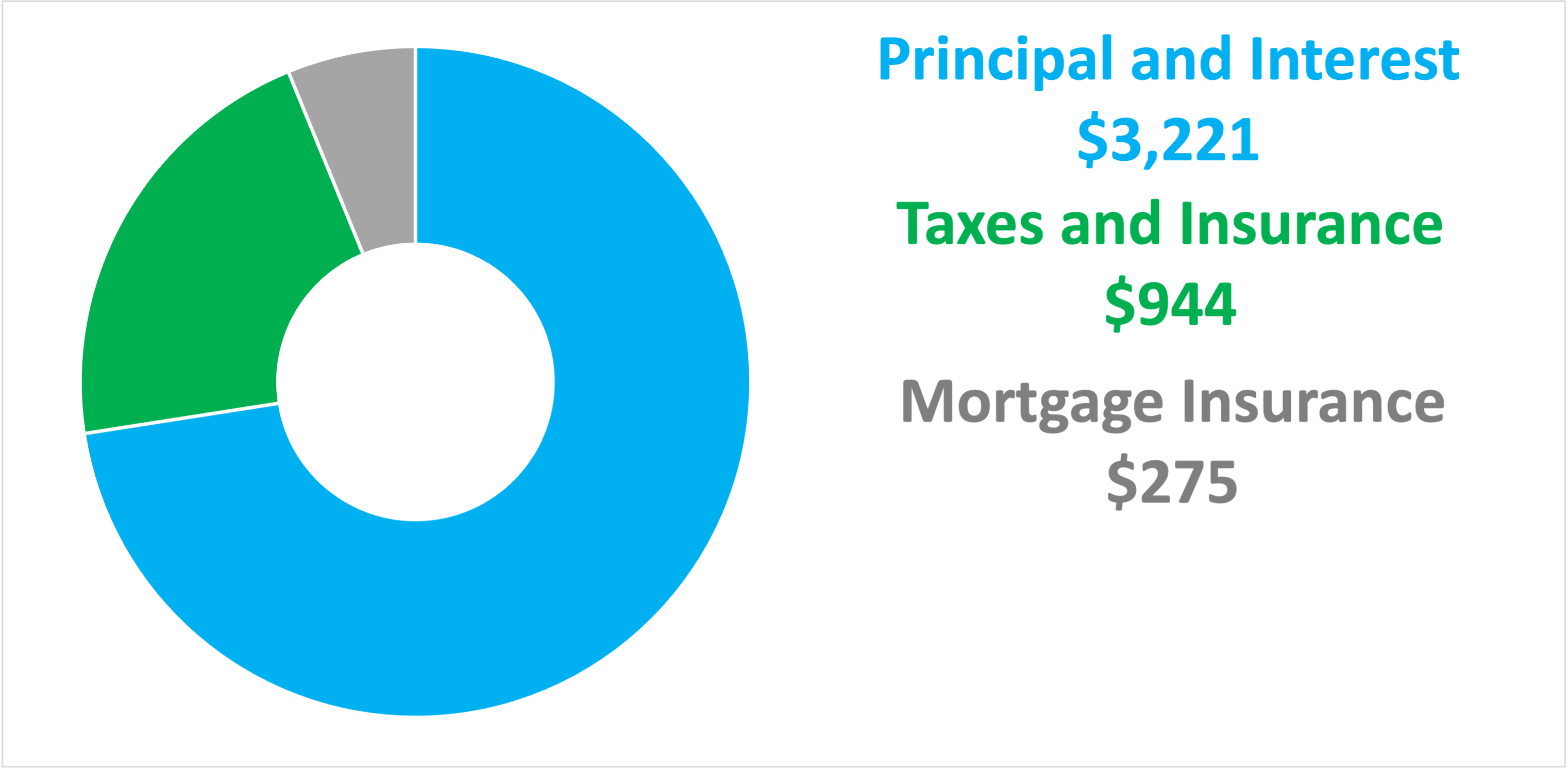

Based on your salary and deposit we estimate you could buy a property valued up to. That 25 limit includes principal interest property taxes home insurance PMI and dont forget to consider HOA fees. To determine just how much you can afford based on your salary be sure to use our home affordability calculator.

You can use the above calculator to estimate how much you can borrow based on your salary. RM17500 Average monthly income. How much can I borrow from my home equity HELOC.

In order to determine how much mortgage you can afford to pay each month start by looking at how much you earn each year before taxes. Calculate your monthly mortgage repayments to see what you could afford to borrow when moving house remortgaging or buying your first home. Do I need to find a home before I use the mortgage calculator.

Convert my salary to an equivalent hourly wage. When it comes to calculating affordability your income debts and down payment are primary factors. The amount of a mortgage you can afford based on your salary often comes down to.

If youre hoping to take out a mortgage our borrowing calculator will give you a rough idea of how much a lender might offer you based on how much you earn and whether youre buying with anyone else. Based on a percentage of the sale price directly impacts your monthly mortgage payment based on a 30-year mortgage at a fixed rate of 4241. Compare an interest-only vs.

And total mortgage amount that you can afford based on your current financial situation. Use our mortgage calculator to see how much mortgage you can get in the UK how much mortgage you can afford and how much deposit you need for a mortgage. 1 Annual i ncome.

How Much House Can I Afford Based on My Salary. Lenders will typically need the rental income to be at least 125 of the monthly mortgage payments on an interest only basis or even up to. Which could include salary wages tips commission etc.

Total subsidized and unsubsidized loan limits over the course of your entire education include. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. What salary do you need to buy.

Home buying with a 70K salary. But ultimately its down to the individual lender to. Factors that impact affordability.

Find out How Much You Can Borrow for a Mortgage using our Calculator. The state of things with your annual salary for the period of the mortgage as well as your credit history. How much you can afford to borrow depends on a number of factors not just what a bank is willing to lend you.

You can also input your spouses income if you intend to obtain a joint application for the mortgage. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances. There are enough exceptions to say that credit policies can differ greatly from one bank to another.

ICB Solutions partners with a private company Mortgage Research Center LLC NMLS 1907 that provides mortgage information and connects homebuyers with lenders. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. It will depend on your Salary Affordability Credit score.

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. A good rule of thumb is to sock away 3 6 months worth of expenses. Many lenders will approve.

Please enter amount here. Find out more in our Guide. How much can I borrow.

Or 4 times your joint income if youre applying for a mortgage. How much can I borrow. Current Mortgage Rates Up-to-date mortgage rate data based on originated loans.

Able to borrow based on salary plus 100 of any supplemental income such as benefits pension income or freelance work. Its an important metric that lenders use to determine how much you can borrow or if you can borrow at all. While your personal savings goals or spending habits can impact your.

Myth 3 Banks only lend up to 70 of your DSR. Maximum borrowing amounts can even differ up to 3x between different banks. Calculate how much house you can afford with our home affordability calculator.

Of Veterans Affairs or any other government agency. And this ladies and gents is the exciting bit. To calculate how much house you can afford use the 25 rulenever spend more than 25 of your monthly take-home pay after tax on monthly mortgage payments.

It is based on information and assumptions provided by you regarding your goals expectations and financial situation. This calculator will also help to determine how. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

Your salary will have a big impact on the amount you can borrow for a mortgage. Like we mentioned above its possible to get a mortgage if youre currently out of work but starting a new job soon. Qualify based on an offer letter for a new job.

To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on.

How Much Can You Borrow For A Mortgage Top Sellers 59 Off Www Ingeniovirtual Com

How Much House Can I Afford Calculator Money

12 Step Guide To Getting Your Finances In Order Learn To Negotiate Salary Bills And Everything Else Personal Finance Books Money Advice Finance

How I Got A Credit Score Over 800 And You Can Too Future Expat Credit Repair Business Credit Repair Check Credit Score

Mortgage How Much Can You Borrow Wells Fargo

Pin By Land Loan Specialists On Oklahoma Land Loan Land Loan Farm Loan Farm

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

600k Mortgage Mortgage On 600k Bundle

Gross Salary Vs Net Salary Top 6 Differences With Infographics Salary Project Finance Business Valuation

How Much House Can I Afford How The Math Works And Rule Of Thumb

How Much House Can I Afford Fidelity

How Much House Can I Afford How The Math Works And Rule Of Thumb

How Much House Can I Afford Bhhs Fox Roach

![]()

How Much House Can I Afford Interest Com

How Student Debt Makes Buying A Home Harder And What You Can Do About It Student Loan Payment Mortgage Approval Student Loan Debt

A Home Of Your Own Home Buying Living Room Accessories Living Room Theaters

I Make 60 000 A Year How Much House Can I Afford Bundle